Mięśnie brzucha to nie tylko "kaloryfer". Sprawdź jak ćwiczenia mięśni brzucha wpływają na całe ciało - Blog Świat Supli

![Gotowy trening na mięśnie skośne brzucha w domu! [4 ćwiczenia] - Motywacja non stop - Trening na płaski br… | Ab core workout, Workout, Arm workouts without weights Gotowy trening na mięśnie skośne brzucha w domu! [4 ćwiczenia] - Motywacja non stop - Trening na płaski br… | Ab core workout, Workout, Arm workouts without weights](https://i.pinimg.com/originals/1b/f1/54/1bf1544b5889d0b9db437e7a7811c512.jpg)

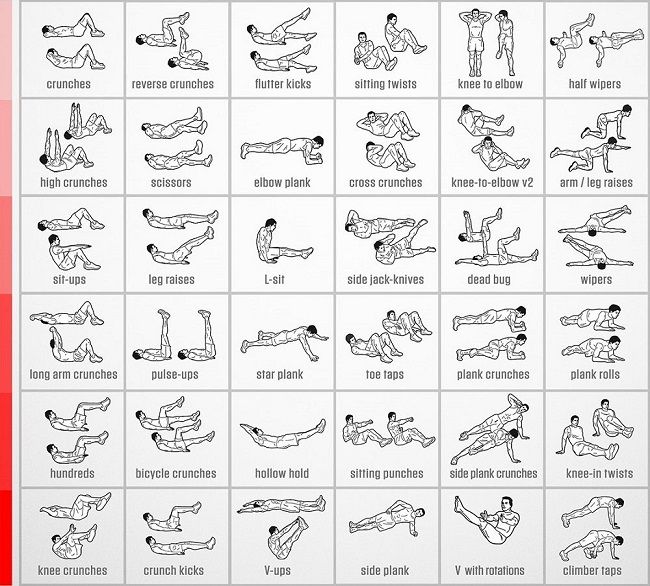

Gotowy trening na mięśnie skośne brzucha w domu! [4 ćwiczenia] - Motywacja non stop - Trening na płaski br… | Ab core workout, Workout, Arm workouts without weights

AboutFootball.pl ⚽️ on X: "Ćwiczenia na mięśnie brzucha – mięsień prosty brzucha i mięśnie skośne brzucha. 💪👊👍 #fitness #trening #brzuch 👉 https://t.co/Sfw7oNW0mo 👍 https://t.co/TAyJmEBKqZ" / X

Mięśnie skośne brzucha - czy warto ćwiczyć? | Mięśnie skośne brzucha - czy warto ćwiczyć? Zastanawiałeś się kiedyś, czy warto włączyć do swojego planu treningowego ćwiczenia na mięśnie skośne... | By Trener Mariusz Mróz | Facebook